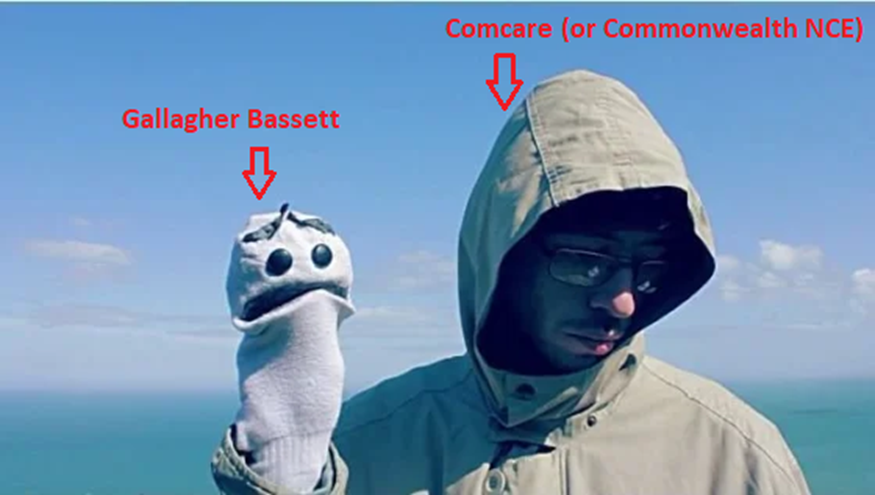

Gallagher Bassett, not worth the money to the taxpayer (in my opinion)

Total incompetence displayed by the insurance company Gallagher Bassett as they are contracted to manage my Comcare claim.

22/7/2023[1]

The Albanese Government wants to reduce its reliance on external service providers, and I present one such service that could be abolished overnight, and I doubt one single taxpayer would shed a tear.

I have a Comcare claim with which I have been dealing with an insurance company named Gallagher Bassett (GB) for a number of years now. I’m going to share what I have learned through the years of dealing with this insurance company and put forward the case that these contracts between the Commonwealth and insurance companies are both unnecessary, and untenable for the government to continue. You might agree, you might disagree, however what I am saying is the truth, and I will put it out there for the court of public opinion.

Comcare delegates some of its claims to be administered by GB (mine is one of these claims). Comcare also allows some Commonwealth agencies the ability to manage their own workers compensation claims with the assistance of GB. As far as I can tell, this scheme allowing Comcare to outsource its claim management responsibilities to insurance companies began under the Morrison Government. It seems interesting timing that Scott Morrison is sworn in as Prime Minister on 24th August 2018, and on 14th September 2018 this arrangement is announced…. it could be purely coincidental as I note it was trailed for a few years beforehand under the LNP Government.

Comcare calls this arrangement of delegating the administration of a claim, a Delegated claims management arrangement.

Comcare did not seek legislative amendment to have claims managed by these insurance companies, and as a result, GB cannot be delegated by the CEO of Comcare to make determinations under the Safety, Rehabilitation and Compensation Act 1988 (SRC Act). GB can only perform the “claim administrative functions”, this means that they can organise IME appointments, send out letters, take phone calls and perform the day-to-day administrative tasks of this nature. GB cannot make a determination (any legislatively backed decisions) on a claim. Only a Commonwealth employee can be delegated the power to make determinations under the SRC Act. But as I’ll show you later on, this does not stop GB employees making determinations and then sending them off to Comcare to be rubber-stamped.

As a result of GB being “powerless” under the SRC Act to perform determinations, it is impossible for Comcare (or self-managing Commonwealth NCEs) to hand over a claim and all responsibilities that come with it completely to GB for it to be handled end-to-end, the Commonwealth still needs to make decisions and payments and other claim related tasks, and this causes a range of issues which I will delve into later.

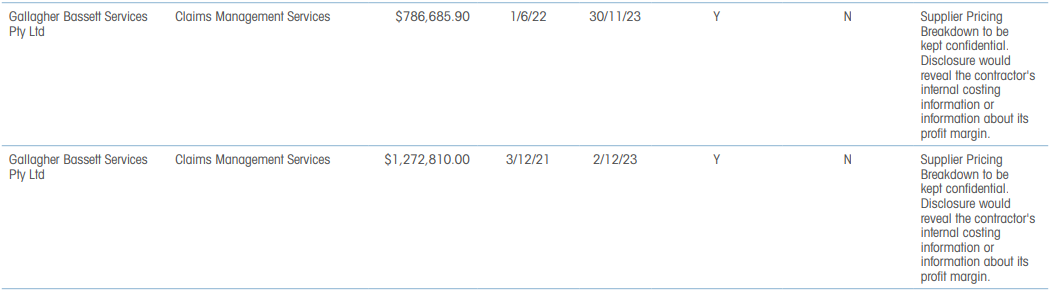

Firstly, how much is the Government paying GB for these “claims management services”? The Senate forces Comcare to produce this spending list, and so we can see how much Comcare is paying for GB to manage claims.

We can see that for the period 3/12/21–2/12/23 (2 years) GB has been paid by Comcare $2,059,495.90, this is just north of $2 million, we could say $1 million per year is the burn rate for Comcare paying GB.

Right, so what does that $1 million buy the people of Australia? It buys us the following GB staff:

- Dannielle Davidson (Branch Manager)

- Belinda Addis (Team Manager)

- John Trungove (Technical Manager — is off every Thursday at least — Retired September ’23)

- Briannca Grant (Senior Case Manager — Moved to Allianz April ’23, position remains unfilled?)

- Sharon Coleman (Senior Case Manager)

This is an average of $205,949.59 per employee if you want to be exact about it, and these are not necessarily all full-time employees given John is absent every Thursday at least.

I don’t know what APS level Comcare delegates are hired at, however obviously the Comcare claims management team has a department head and relevant executives already, therefore like for like, GB staff would be replaced with APS staff if the GB contracts were abolished. I would imagine that new/junior Comcare delegates would be at the APS 4 level with senior delegates being APS 6 level. With this in mind, let us assume that we can replace the above 5 GB staff with 3x APS 4 staff and 2x APS 6 staff at Comcare. I’ll use the highest current pay tiers which means in the last 2 years the cost would have actually been less.

APS 4.4 = $78,248 + 15.4% superannuation = $90,298.19 x 3 = $270,894.57 APS 6.4 = $99,780 + 15.4% superannuation = $115,146.12 x 2 = $230,292.24 Total = $501,186.81

$501,186.81 for APS staff vs $1,029,747.95 for GB staff! That’s doubling the cost to the taxpayer! How can this be cost effective? I say it isn’t.

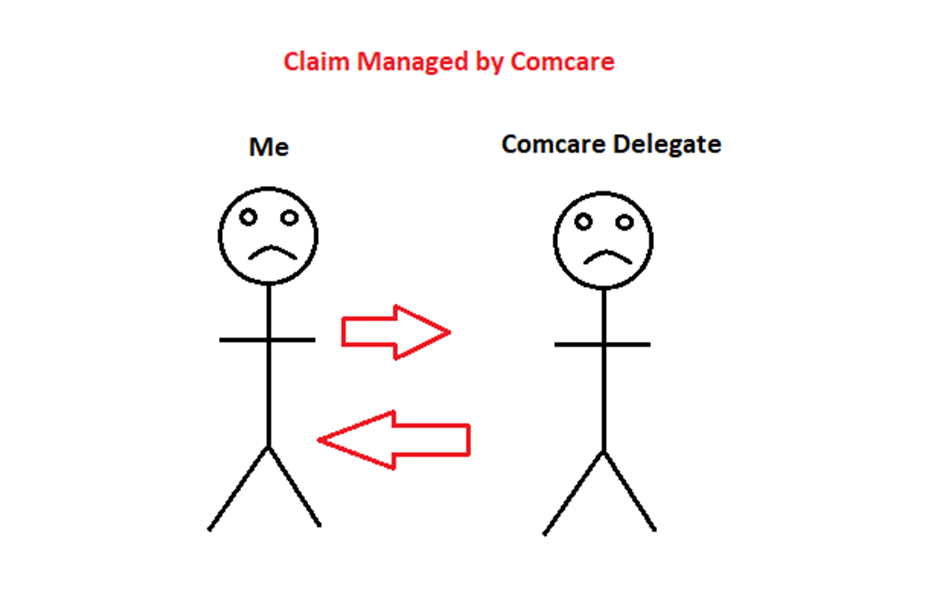

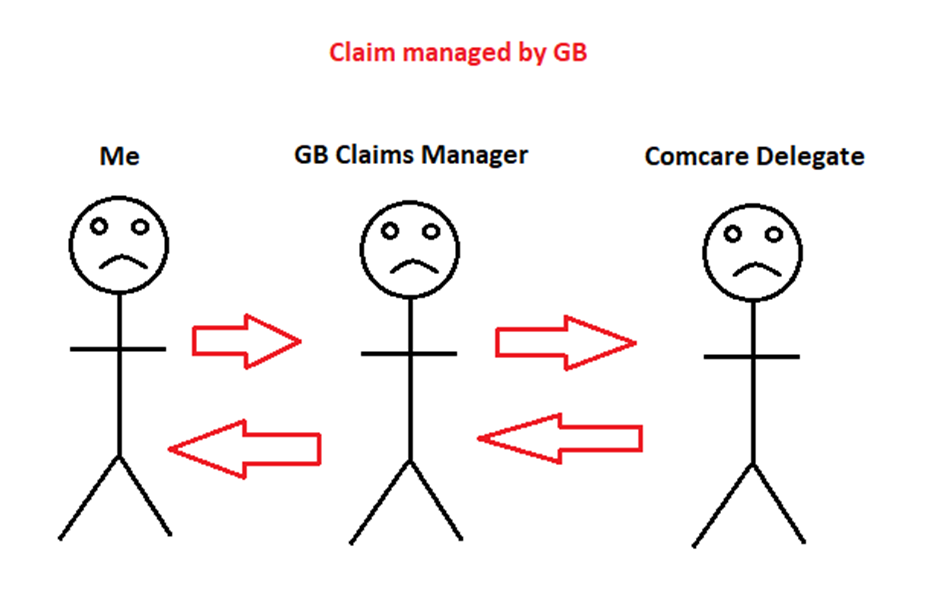

We can see that it is more expensive for GB to administer claims, so is there any benefit at all to the taxpayer? No! The process of delegating claims management introduces inefficiencies. For a start, a claim that is managed by Comcare can be managed by a single delegate. This single delegate can make the determination, and then do all the necessary management tasks end-to-end. When a claim is delegated to GB, it requires at a minimum 2 staff because it requires a GB staff member to perform the management tasks, and it requires a Comcare delegate to make the determinations.

I will make some illustrations to show the difference in staff and how information flows between a claim that is managed natively by Comcare, and a claim that is managed under a delegated management arrangement with GB.

As you can see, a claim managed by Comcare requires 1 staff member, a claim managed by GB requires 2. This is entirely inefficient, not only is the Commonwealth paying double for the staff, but those staff can only do half the job. How is this logical? It isn’t.

If you have a question about your claim, you cannot ask Comcare. If you ring up Comcare, they look at your claim and they tell you that because your claim is managed by GB, you must contact GB. If the GB staff member is on leave for a month, tough luck, nothing happens on your claim for a month. Talk to the wall. And then maybe the GB staff member comes back from a month of leave, and now the Comcare staff member goes for a month of leave. Now your claim is going nowhere for a minimum of 2 months. If you think this is a far-fetched scenario, it isn’t.

I still have incapacity payments owed to me from July 2022 — current. That’s a year ago…. and that’s not even the worst delay. I only just got paid everything owed to me from September 2020 — June 2022 on the 11/7/23. It took me a 34 month+ process, many of these months fighting with these non-thinkers to finally get paid. Even when I was paid initially in April 2023, they stuffed it up and it took another 2 subsequent payments (6/7/23 and 11/7/23) to finally pay me what I was owed for that period. If there is something to get wrong in this process, you can be assured that they will get it wrong.

To this day I am still unable to get a payslip from them that contains correct information, the current payslip before me has a YTD net figure of thousands of dollars more than I have actually been paid…. it’s a complete nightmare having a claim managed by GB.

I mentioned earlier about GB employees making determinations, what happens is Comcare tells GB to make a determination, so GB collects all the information and makes a determination, GB then sends that determination to the Comcare delegate and the Comcare delegate is supposed to review that determination and then they issue the determination if they are happy with it. In reality, this is not what happens. In reality GB make a determination, Comcare does not even review it, the Comcare delegate rubber-stamps it and you get sent a determination made by some high school drop out that GB has hired, and it breaks the law. I have had a determination presented to me that:

a) Took my financial year earnings and averaged them weekly Robodebt style (They Robodebted me)

b) Used the wrong figure from my tax return as my earnings

c) Did not use the correct formulae specified in the SRC Act (2C and 2D were missing completely)

d) Did a partial week calculation of incapacity (which is not possible, the applicable s.19 3 f formula can only be done over a week period) but then they calculated a full week first and then went x 0.8 to provide the partial week... this defies logic.

The above issues are not even all the issues that were wrong with the determination. I had to write a 21-page reconsideration request showing all their errors (which they ignored and decided to reconsider their own motion to avoid admitting their errors).

I have been advised that John Trungove, as the “Technical Manager” for Gallagher Bassett, is the “expert” that Gallagher Bassett turns to when complex incapacity calculations are required. It is my understanding that John is the Gallagher Bassett common denominator across all the incorrect determinations issued to me.

The first determination that John put to Comcare, he tried to do an illegal determination of my earnings, however Comcare identified John’s illegal determination and they rejected it before it was signed by a delegate, thanks in part to me questioning why they were seeking certain information, and then me telling Comcare that the information GB was seeking was irrelevant.

With John’s initial determination being rejected, he had to come up with a new one, and he did, he presented the one I listed above that contained a whole bunch of errors. When I looked at section 19 of the SRC Act, he hadn’t even used the correct formulae for a start (there was no 2C and 2D), it was completely error ridden. Next Comcare performed what is called a “Reconsideration of own motion” (RoM) which means that they identify an error and correct it. They pretended most the errors I said didn’t exist, but for the most part they did silently correct those errors without mentioning them. Why the silence? I have a few theories, but this is another story.

So, I now have a RoM before me and do you think it is correct? Do you think when GB corrects their errors and create a second determination, the next determination they give me is correct? Think again…. it isn’t. John Trungove simply does not know how to apply the SRC Act, I present this as a statement of fact.

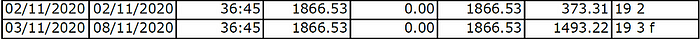

Here is a row from spreadsheet that was sent to me before the formal RoM was issued, note the date range and the formulae applied as per the SRC Act. This is in fact correct, this is what should have been determined:

Now let us look at what was actually sent to me in the RoM:

We have what I was provided pre RoM, and now we have the RoM (the OFFICIAL determination), now let’s look at the payment sheets that were generated by Pracsys (Comcare’s claim management system) when I was paid:

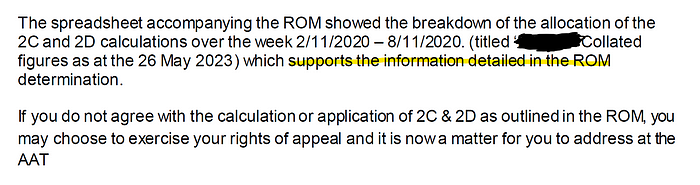

As you can see in the above pictures, I was provided a date range 2/11/20–8/11/20 for the 2C and 2D calculations. In actual fact I provided these calculations because neither Comcare nor GB knew how to do them (and evidently, they still do not), so this is GB repeating me back to me in this instance.

I then received a RoM with completely different dates. The dates are contradictory, the way the 2C and 2D are calculated is that the 2C covers the first portion of the weekly reporting period, and the remainder of the week is covered by a 2D calculation. This means that in the spreadsheet and the payment sheets generated by Pracsys, the 2C calculation starts on 2/11/20. In the RoM, the 2C starts on the 6/11/20…. this is simply not possible, the date ranges contradict each other. The 2C can either start on the 2/11/20, or it can start on the 6/11/20, but it can never start on both dates…. these dates are mutually exclusive. And the same goes for the 2D, in the spreadsheet and the Pracsys sheets, the 2D calculation ends on the 8/11/20. In the RoM the 2D calculation ends on the 12/11/20. The 2D calculation either ends on the 8/11/20, or it ends on the 12/11/20, but it cannot end on both. Again, these dates are mutually exclusive. How can this be possible? it cannot, the RoM is wrong, it literally defies logic. A 5-year-old child can tell you that these date ranges do not align. I’d also like to point out that if someone gives you the answer and you still get it wrong…. you’d have to admit to being a retard at that point would you not? I literally gave them the correct calculations and they still got it wrong. Maximum shame.

I am headed to the Tribunal (AAT) to spank their bottoms about it, but it is frustrating and deeply concerning that neither GB nor Comcare can see this error.

I have tried to raise it multiple times and each time they are trying to pretend it’s not an error.

Dannielle Davidson is John’s boss, and I have told her both in writing and on the phone this problem. I have asked her to get John to demonstrate how he can calculate the 2C and 2D on these dates because it cannot be done as per the law, it is an impossible determination.

In my view Dannielle serves limited purpose but to try and cover up the failures of her subordinates.

When provided with the above date conflict, and issued a “please explain” as to why the date ranges are different, here is what Dannielle had to say:

As you can see, this is a total fiction. The spreadsheet does not support the RoM in any way, nor does the Pracsys sheets which she ignored addressing. The RoM is wrong and both Comcare and GB are ignoring that fact, they are sticking their heads in the sand and forcing me to the Tribunal at the expense of the taxpayer. Anyway, this will be heard in the Tribunal now (I have applied), so they are just delaying the inevitable, but this behaviour costs the taxpayer money. Comcare hires a senior AGS lawyer to represent them at (according to AGS rates) $521.74 per hour. Comcare will happily pay $521.74 per hour just to go to the Tribunal and be told that they are wrong…… why should the taxpayer wear this cost? I am being pro-active and identifying the error without the need to go to the Tribunal, and without further expense to the taxpayer, but Comcare is forcing it to go to Tribunal at taxpayers’ expense!

I have already been to the Tribunal before, and Comcare capitulated before we got to a hearing. This of course is at great cost to the taxpayer who funded the AGS senior lawyer, and also a waste of the Tribunal’s time and resources. Comcare paid thousands of dollars in legal fees to turn around and concede just before a hearing! Why? Is it normal for the government to waste money like this? What makes it more egregious is I am doing everything in my power to avoid them from having to pay this money, and they are still busting a nut to waste public money, it’s like they are doing it on purpose!

Update 26/7/2023

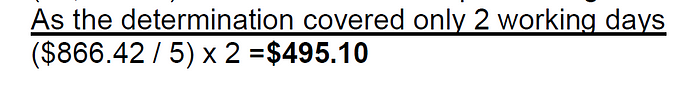

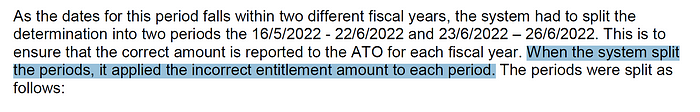

Today I was provided with the following example of creative mathematics that Gallagher Bassett love to deploy to justify their failures.

According to Gallagher Bassett, 866.42/5 * 2 = 495.10 …… it doesn’t…..

Dannielle Davidson is so incompetent that she has now demonstrated a total failure of grade 3 math.

Allow me to provide the correct working out of the above sum:

866.42/5 = 173.284 * 2 = 346.568 (this would be rounded to 346.57)

This is what happens when the government allows insurance companies to run the show, we end up with even math being corrupted to attempt to justify their failures. This is a total injustice, and an insult to the people of Australia when these insurance companies tell us that 1+1=3.

In the past I have been told that claims go through a Quality Assurance (QA) process by Comcare at the tail end of the determination. Well how did QA not pick up this basic mathematical failure? Where is the assurance of quality here? Comcare has become so reliant on these insurance companies that they are not even bothering to check what they are receiving from them. This is a big problem, and it is hurting injured Australians.

Update 30/7/2023

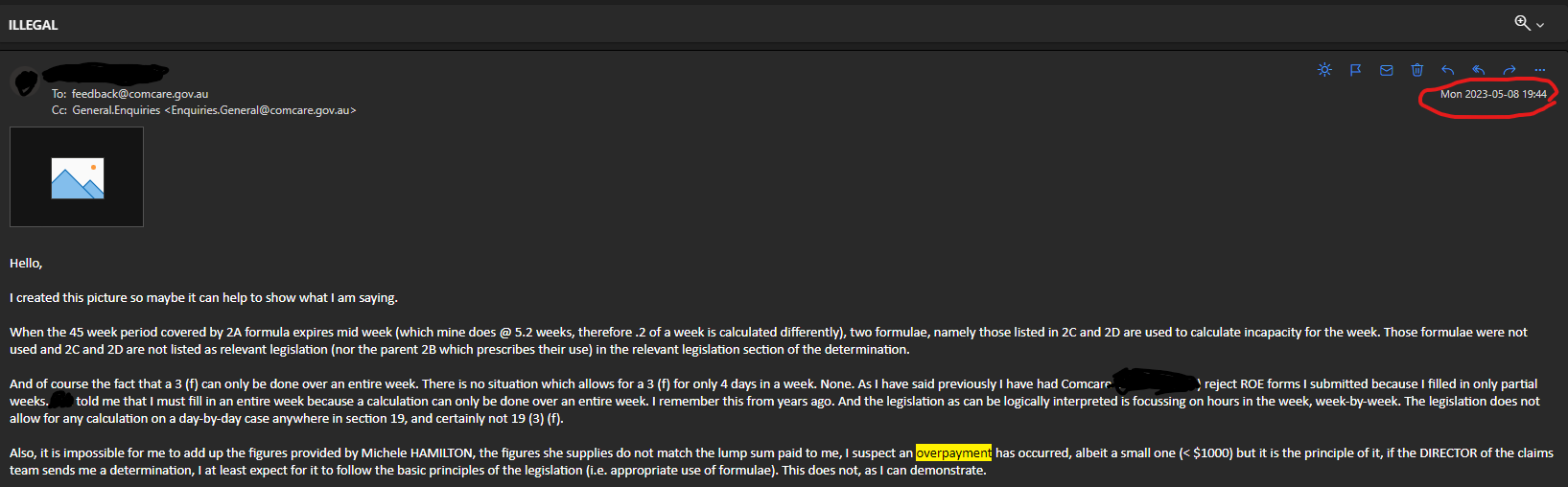

The above faulty calculation by Comcare resulted in an overpayment in April 2023. I actually tried to calculate the figures Comcare had provided to me and I identified that the math did not work at all, I suspected I had been paid an overpayment, this is now confirmed to be true.

On the 8th May 2023, as you can see in the below email snapshot, I informed Comcare of the potential overpayment. Comcare did not take me seriously when I mention they may have overpaid me. It seems to me that there is no point letting Comcare know if they make an overpayment, they just assume they are right and will ignore you telling them, so don’t bother informing Comcare about any overpayments. Use my case as a precedent to demonstrate that they do not care about overpayments, as I notified them and they did nothing, so what is the point of informing them?

Update 4/8/23

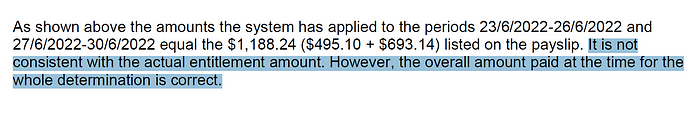

The plot thickens with this. I have finally received a response yesterday regarding the faulty math. Read it for yourself:

“It is not consistent with the actual entitlement amount”

This is correct, it’s not…. as I have pointed out…. and this is where the sentence should end because it MUST be consistent with the actual entitlement amount. If it is not, it needs to be fixed. There is no “but” or “however” about it. What Gallagher Bassett is saying here is that it doesn’t matter if the math is wrong in *part* of a larger determination… as long as it all adds up to a final sum in the end, it is ok to have errors in the determination.

Really? So the standard set by Comcare is that a determination doesn’t have to be good…. it simply has to be good enough? I see. There you have it people. “Not good but good enough”, that’s my new slogan for Gallagher Bassett. But actually, this error has negative tax consequences for me, so it might be good enough for them, but it is not good enough for me.

Something else that I thought was interesting in the response:

Why would the system calculate the math to be $346.57 and then change it to $495.10? I cannot see how this can happen with my knowledge of the calculations occurring here. I believe this statement is a lie.

A system error? Gallagher Bassett is forced to use Pracsys so this error will apply to Comcare, DVA and any other self-managing agency. According to Gallagher Bassett, Pracsys makes errors…. interesting position of liability to admit to…. Apparently, the system (Pracsys) picked an incorrect rate to calculate a particular period….. except it magically all adds up to what they expect? Does that make sense to you? It doesn’t to me. And what’s more concerning about this is if Pracsys is making errors like this, who else has a determination impacted by this system error? This smells of a systemic issue to me if the “system” is making errors. It’s normal for humans to make errors yes, but for the “system” to make an error? This is indicative of a coding error in the Pracsys software, a bug, and that is absolutely concerning, more concerning than a human getting math wrong.

Also, given they have admitted that Pracsys applied the wrong rate (I actually don’t think it did, I think they are lying to try cover up for their embarrassing math fail 😜), but if Pracsys genuinely has stuffed up and applied an incorrect rate…. why haven’t they fixed it? Surely if they admit there is an error in the determination caused by Pracsys, even for compliance sake, to make sure the system doesn’t continue to make errors they would want to fix it and demonstrate to me that the system can compute a correct result, right? Apparently not. Apparently “the system makes errors, don’t worry about it just accept the errors because it all adds up if you ignore the errors” is the right call to make here. But it’s not, as I say, it causes negative tax consequences for me by shifting a portion of payment into an incorrect financial year, so it actually has to be resolved, they cannot get out of it.

The Solution

Tear up these contracts with insurance companies and instead invest the money into Comcare. I use the word “invest” because it is a genuine investment. An investment in the health and wellbeing of injured Commonwealth (and ACT state) workers of Australia. To spend twice the money to purchase someone who does half the job is straight up insulting.

Invest in Comcare, instead of requiring 2 people to do a claim, build more FTE positions in the Comcare claims management team that can handle claims end-to-end. This will eliminate many problems and be significantly more cost effective to the taxpayer.

I would be very interested to see the costings of these delegated arrangements, they have to be comprised of lies, how can it ever be deemed cost effective to pay 2 people to do the job of 1 person? (unless you are paying 2 people as part-timers equivalent to 1, which is not the case here). I think this could legitimately be an example of corporate political donations paying dividends here, where the Government is fudging figures to line the pockets of industry buddies. That, or perhaps someone is so ignorant that they actually thought this was a good idea….. surely nobody actually thinks this is a good idea? I know for a fact some people at Comcare are against this and also think it is dumb.

I have tried to bring issues before the responsible Minister, Tony Burke MP, Minister Burke has no time for me. Apparently, I have no voice. I try to raise concerns with the relevant Minister and I am denied. It’s funny that we’re being asked to vote to give people of another race a voice to parliament, when we cannot even have an appointment with the responsible Minister and have a voice of our own…….. proper madness.

Also, I would like to add that in my view, the following people have no business at Comcare, given the fact that they are making errors and not acknowledging their mistakes, lying to me, and/or turning a blind eye to the issues that are occurring, I consider that they are an insult to the taxpayer:

Greg Vines

Renee Handwerk (No longer at Comcare as of August ’23) <- I apologise to Renee, I have since heard she left because of what Comcare is doing to claimants, and so she has restored her credibility in my opinion. I suspect she was forced to do some things, I will assume so given her departure soon after.

Catherine Chan

Elizabeth Caitlin (Liz) Bell

Michele Hamilton

Lisa Watt

Aaron Hughes (No longer at Comcare as of May ’23)

A story for another day, but when I do tell my story you’re going to fall off your chair, it is proper cooked the culture at Comcare and what these people can get away with. A zero-accountability culture at Comcare.

Reach Out

Seeing as I have now had 2 formal determinations in a row made by GB that contain errors of law, and a number of informal ones that were knocked back before being formalised, to me this is evidence of systemic ineptitude. GB does not know how to apply the SRC Act, this is a fact that I can prove. And so there is every chance that if you have your Comcare claim managed by GB that it is wrong.

I am offering a free service to anyone who has their Comcare claim managed by Gallagher Bassett, I will review your determinations and let you know if it appears to be correct as per the SRC Act, because it is entirely evident to me that GB simply does not know how to apply s.19 of the Act (also s.58 they struggle with), and every determination they have ever made on my claim has been wrong.

See the contact page for ways you can contact me

1 - As at this date Gallagher Bassett was provided with the opportunity to comment/correct any part of this article before publishing. All this information has been sourced by me throughout the life of my Comcare claim. I stand by it as true and accurate and will happily be pulled up on it in court or whatever.

![ATO HR uses false allegations of "sexual harassment" as a tool to try remove employees from the Org [Part 1]](/content/images/size/w960/2024/08/HR.png)